Spendings on Xaas, including SaaS and IaaS will grow by 2023, according to IDC

Worldwide spendings on cloud services will grow more than 2x in 2019-2023 period, from $229 billion to almost $500 billion (in 2019 and 2023 respectively). Compound annual growth rate (CAGR) will be at 22,3% according to IDC forecast.

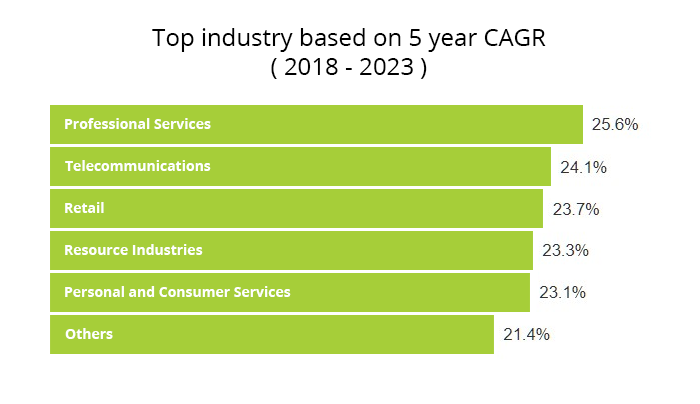

According to researchers, public clouds adoption will grow as companies will replace legacy apps with SaaS and internal IT-infra with IaaS. It's especially true for professional services, telecom, and retail - to enhance customers’ experience and to move forward with digital transformation projects.

SaaS will be the most popular model among others. More than half of all cloud spendings in 2019-2023 will be in SaaS.

SaaS spendings include applications and system infrastructure software (SIS); leaders in applications category will be customer relationship management (CRM) and enterprise resource management (ERM), while in SIS - security and system/service management apps.

IaaS will be the second after SaaS, but with a higher growth rate (32% CAGR). PaaS will be close with 29,9% CAGR. This growth will be driven by an interest in data management, application platform, and integration&orchestration software.

Professional services, discrete manufacturing, and banking will be three industries concentrating one-third of all public clouds spendings.

SaaS will be accountable for the biggest spendings across all industries. However, IaaS will grow in areas related to data and intensive computing. So IaaS spendings in 5 years will be more than 40% of all clouds spendings for professional services companies, while less than 30% for other industries. Professional services will also experience the biggest growth rate - 25.6% CAGR.

Geographically the US will be the biggest public cloud market with more than 50% share. The second one will be Western Europe with 20%.

The biggest growth rate will be in China (49.1% CAGR). Latin America will achieve impressive 38.3% CAGR.

Very large enterprises (over 1000 employees) will be accountable for more than 50% of all public cloud spendings by 2023, medium-size (100-499) - for about 16%.

Large enterprises (500-999 employees) will have a lead of a few percentage points of small ones (10-99 employees). Small offices (1-9 employees) will deliver just a few percents.

All companies excepting the very large ones will face growth in cloud spendings greater than in other categories.

The IDC guide measures public cloud spendings for 79 technologies, 20 industries, 5 company sizes, 9 regions, and 53 countries. This guide was created to help IT decision-makers to better understand the scope and direction of public cloud spendings today and in the 5 upcoming years.

Comments